The Ever Rising Cost of Higher Education

Earlier this month, a confidential government commissioned report concerning university tuition fees was released. Entitled ‘Funding Irish Higher Education: A Virtuous Circle of Investment, Quality and Verification,’ the report suggested that rather than paying college fees up front, students should have the option to pay back a loan after they have completed their studies. It called the proposed system “very affordable,” emphasising that it would allow more and more students across the country to receive third level education. University would become free at the point of access – anyone could attend. To some, the idea was the lifeline they had been waiting for. For others, it sounded like a complete disaster.

According to the report, the new system would allow for a greater State contribution towards college fees, more and more grants for families living on low incomes, and the introduction of an income-contingent loan scheme for those who need it. Supposedly, the system would ensure that everybody gets an equal chance at an education, eradicate the need for university debt collectors hunting students down on campus while they desperately struggle to get that final project submitted, and allow everyone to complete their studies without ever having to worry about fees! That would be, until, they had to pay them off.[pullquote]University would become free at the point of access – anyone could attend. To some, the idea was the lifeline they had been waiting for. For others, it sounded like a complete disaster.[/pullquote]

According to the report, the new system would allow for a greater State contribution towards college fees, more and more grants for families living on low incomes, and the introduction of an income-contingent loan scheme for those who need it. Supposedly, the system would ensure that everybody gets an equal chance at an education, eradicate the need for university debt collectors hunting students down on campus while they desperately struggle to get that final project submitted, and allow everyone to complete their studies without ever having to worry about fees! That would be, until, they had to pay them off.[pullquote]University would become free at the point of access – anyone could attend. To some, the idea was the lifeline they had been waiting for. For others, it sounded like a complete disaster.[/pullquote]

As soon as a student gets a job meeting the minimum income requirements, they would have to start paying back their tuition loans. While the report did not specify exactly how much these fees would amount to, it did suggest that graduates would be forking out about €25 a week for the 15 years following them getting employed. That’s an extra €1,300 a year. Somewhere around €19,500 overall.

It’s difficult to imagine that such a system reflects the fair alternative to rising fees that Irish students have been protesting for years. Affording three grand a year for tuition alone is no easy feat for a lot of students, especially if they are already struggling to support themselves. Adding another decade and a half of loan repayments hardly seems like an all-encompassing solution to their problems.

USI President Kevin Donoghue doesn’t think so anyway. Following the release of the draft, he stated that income-contingent loans did not address the high costs that students already face in Ireland, and that rather than allowing equal entrance opportunities for everyone, it would give high income families a distinct advantage. Speaking to the Irish Times, Donoghue said:

If you are able to pay the fees, or if your family is in that position where they can cover the cost without having to take out a loan, that would put you at a significant advantage later in life.

Donoghue also expressed concern for the pressure the scheme would inflict upon students who have yet to decide on a specific college or course, as their decisions would be influenced by the existence of impending loan repayments once they had graduated and needed to start looking for a job. He rejected the proposition, claiming that it would

… Force people to focus on the economic output of their course as opposed to the benefit it would generally bring (…) I would have huge concerns about that.

It’s not unfair to say that getting a decent job and earning a bit of money is the probably the endgame for the vast majority of university students in Ireland – and that a lot of courses are most likely selected based on employability – but nobody wants to be crippled with debt after they graduate. Repaying loans well into your thirties isn’t just something that a lot of people would be unhappy doing. For some, they simply wouldn’t be able.

UCD lecturer Dr Kevin Denny supports the proposed income-contingent system, and has stated that it is the only fair way of paying for third level education. In a piece published by the Independent this month, he said that “If you go through college and become a brain surgeon and make a fortune, it doesn’t make sense that you don’t have to pay for it.” But what about everybody else who won’t become brain surgeons? What about those of us who won’t make a fortune, and are left struggling to fork out an extra €1,300 a year just because our incomes barely scrape past the minimum requirements? What about those who have incomes that don’t?

Apparently, they won’t have to pay. According to the proposed system, a graduate won’t owe anything until they have a job that meets the minimum income – which doesn’t sound so bad until you consider that universities and colleges around the country are already owed over €17 million in unpaid tuition fees. Either the group who drafted this report are extremely confident that the vast majority of students are going to obtain high paying jobs upon finishing their studies, or the minimum income specifications are going to be set incredibly low.

As it stands, Ireland already has the second highest third level education fees in Europe. The highest exist in England where students currently pay £9,000 a year for their undergrad, and spend the next decade or so paying it all back through direct debit. The report was far from inaccurate when it stated that there are no “easy fixes or escapes from the funding reform problem,” and yet, the adverse reaction to the proposition suggests that a loan system would only contribute to the monetary concerns of many students, rather than solving them.[pullquote]The adverse reaction to the proposition suggests that a loan system would only contribute to the monetary concerns of many students, rather than solving them.[/pullquote]

While many people have expressed their support of the report, claiming that it would have eradicated a great deal of financial anxiety if they had had the option to avail of it during their time at college, it still remains unclear as to exactly how much tuition would cost, and how much interest graduates would be forced to pay.

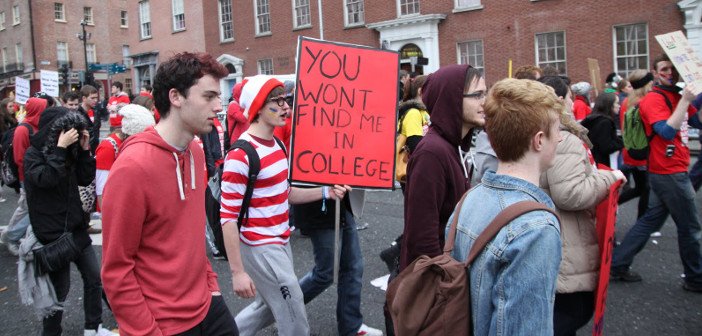

Over the years, Irish students have called for the complete abolition of college fees and the introduction of systems akin to those operating in places like Scotland and Germany, where tuition is completely, or at least almost, free.

However, pumping more and more money into ensuring that fees don’t exist has actually provoked a negative reaction from some Scottish citizens who claim that the system only benefits the middle class, who can already afford the extra costs associated with student living. Rather than securing grant money for disadvantaged students, the system ensures that student caps are in operation, that universities have less funding for outreach programmes, and that the poorer you are, the more debt you will have to pay off.

However, pumping more and more money into ensuring that fees don’t exist has actually provoked a negative reaction from some Scottish citizens who claim that the system only benefits the middle class, who can already afford the extra costs associated with student living. Rather than securing grant money for disadvantaged students, the system ensures that student caps are in operation, that universities have less funding for outreach programmes, and that the poorer you are, the more debt you will have to pay off.

Contrasting this, evidence suggests that there isn’t much of a class divide in most German universities as students tend to be local, and administrative costs are substantially lower. The elitism associated with places like Harvard, Oxford, and even Trinity College appears to be almost nonexistent, and although the classes are larger, German students are still receiving a good education.

So where does all of this leave Irish students? Paying an extra €250 every semester as the government continues to steadily increase fees? Or spending the next 15 years paying off loans that may or may not put an incredible strain on our finances? Free third level education may be difficult to achieve – and strenuous to sustain fairly – but it is not an impossibility.

College is tough. Keeping your GPA up is hard. And for some, just finding enough money to attend is even harder. But that’s not going to stop people from trying. The coming decade is expected to see a 30% increase in registered college students across the country – the least the government can do is make it a little bit easier for them to stick it out.

Images via

irishtimes.com

boomingback.org

Brian Fallon/journal.ie

aarp.org

betterment.com